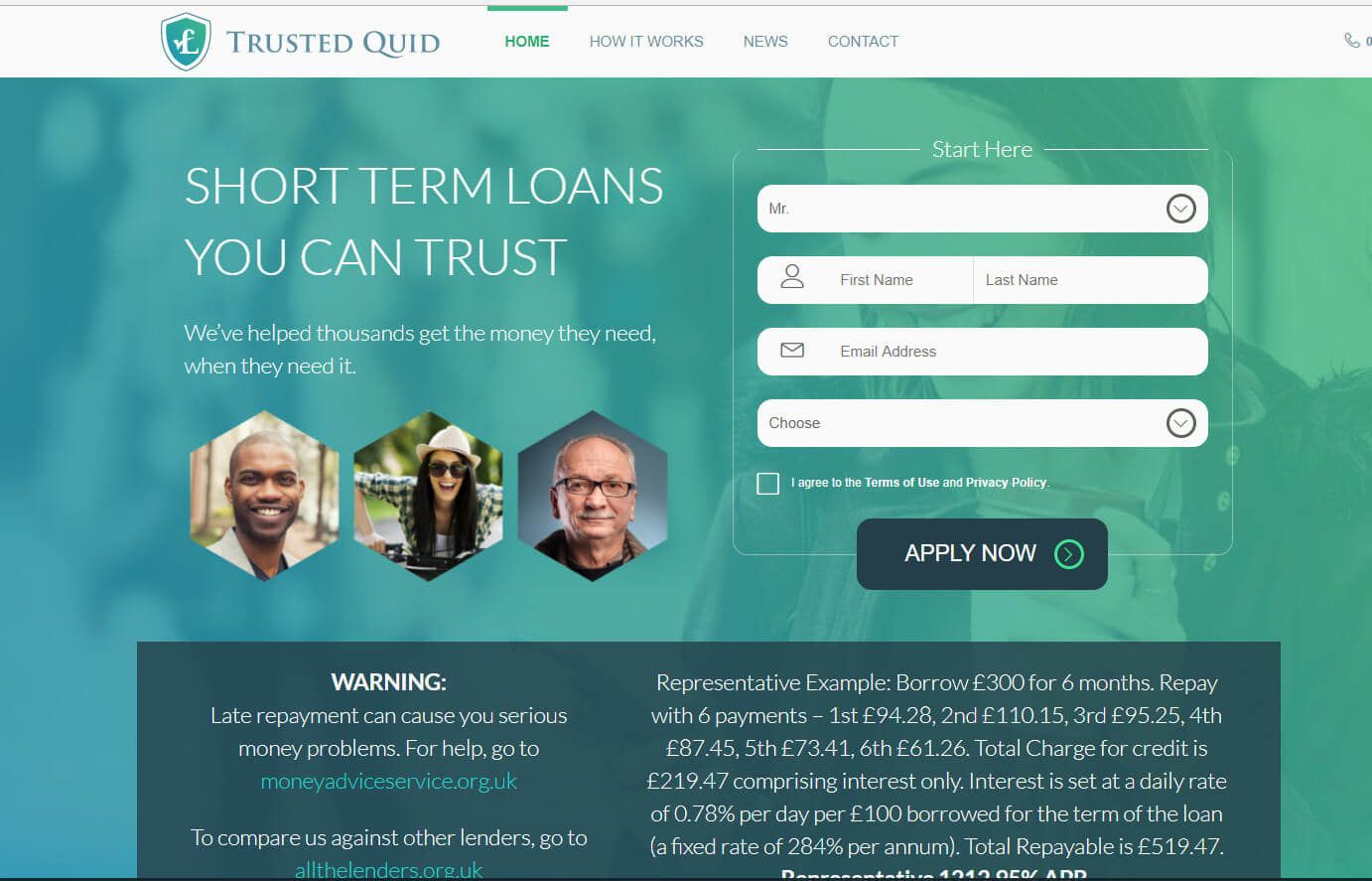

Could I still get a loan with Trusted Quid?

Trusted Quid is no longer trading, and it’s not possible to apply for a loan with them. If you’re looking for a short-term loan, CashLady could help you search for a suitable Trusted Quid alternative.

CashLady Representative 79.5% APR

What happened to Trusted Quid?

Launched in 2011, Trusted Quid was a trading name of Trusted Cash Limited and entered into liquidation on September 23, 2019.

Joseph Walter Colley and John Anthony Dickinson of Carter Backer Winter LLP were appointed as joint liquidators.

Loans like Trusted Quid

The lenders on the CashLady panel offer short-term personal loans from £100 to £10,000, with a range of repayment terms between 3 and 60 months.

The repayment terms available to you will depend on the amount of money you apply to borrow.

Searching for a Trusted Quid loans alternative with CashLady

CashLady welcomes anyone who meets the criteria below to search for a suitable loan.

You must:

- Be over the age of 18;

- Be a UK resident;

- Have a UK bank account and a valid debit card; and

- Have a regular source of income paid into your bank account.

Loans like Trusted Quid: loans for bad credit

CashLady works with a number of lenders who specialise in loans for people with bad credit, and they could be willing to consider your application.

Before you decide to search for a bad credit loan, it’s worth noting that loans for people with bad credit could come with a higher rate of interest. This will increase the overall cost of borrowing.

I have bad credit; will searching for a loan make my credit score worse?

Searching for a loan with CashLady will not affect your credit score. This is because we use soft search technology at this stage to look for a lender.

If we’re able to match you with a loan and you make a full application, the lender will carry out a creditworthiness assessment. This will involve either a hard search or an Open Banking check. Please be aware that a hard search will be visible on your credit file for up to 12 months and will affect your credit score.

Your credit score could decline if multiple hard searches are carried out in a short space of time.

Using a credit broker: how does it work?

We’ve outlined each step in the CashLady journey below to show you how it works.

- Fill out our online form. It’s straightforward; you’ll need to let us know how much money you need to borrow and for how long, as well as provide us with some information about yourself.

- We’ll run a soft search and scan our panel of lenders for a loan that could suit your requirements.

- Success! If we’ve matched you with a loan, you’ll be redirected to the lender’s website. From here, you can decide whether you’d like to make a full application.

- The lender will complete a creditworthiness assessment, and this will include a hard search or an Open Banking check.

- If you pass the lender’s checks, you’ll be offered the loan.

Will CashLady charge me any fees?

No. Here at CashLady, we do not charge any fees for our credit broking service.

If I’m approved for a loan, when will my money be sent?

This will depend on your lender’s payout timescales.

In some circumstances, Trusted Quid were able to offer same-day payouts, and some of the lenders on the CashLady panel could also send your money on the same day as your application is approved.

While your funds could be sent the same day, it’s important to remember that the time it takes for the money to become available in your account will depend on your bank’s policies and procedures.

What will my repayment schedule look like?

Your short-term loan will be repaid in monthly instalments over the course of your chosen term.

If you’re concerned about an upcoming repayment, you should contact your lender as soon as possible. Don’t wait until your repayment date has been and gone; a missed or late repayment will harm your credit score, and you could be charged a fee by your lender.

Money worries? We can help point you in the right direction for support

If you’re concerned about your finances or debt, please consider contacting any of the following charities and organisations for free, confidential advice: StepChange, MoneyHelper, Citizens Advice, and National Debtline.