Is CashASAP a legitimate company?

Yes, CashASAP is a trading name of APFIN LTD, authorised and regulated by the Financial Conduct Authority (FCA).

You can read CashASAP’s customer reviews on Trustpilot, where they’re rated ‘Excellent’ with an overall average score of 4.6/5, as of June 2025.

How much money could I borrow with CashASAP?

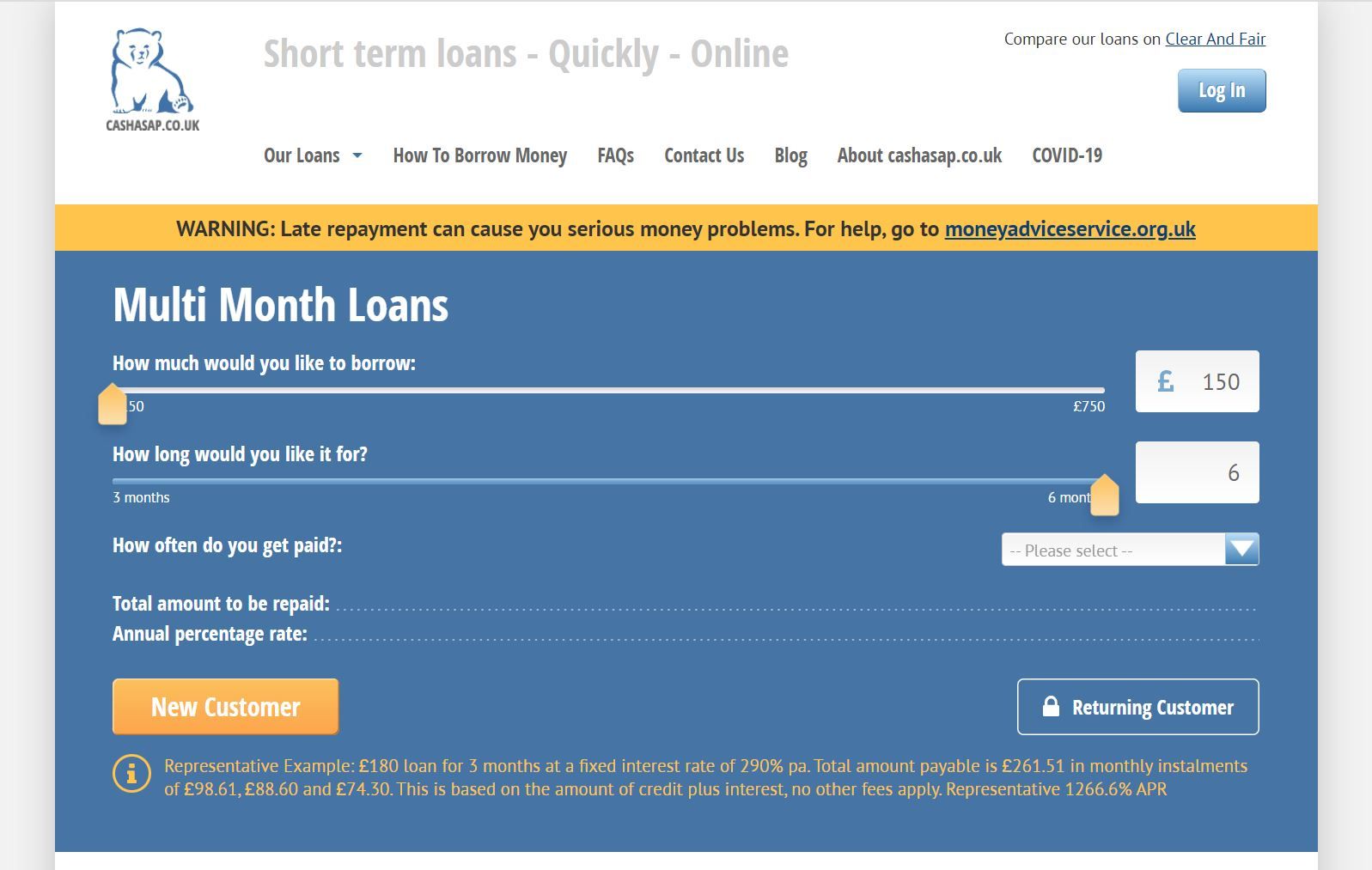

CashASAP offer new customers short-term ‘multi month’ loans between £200 and £400. If you’re a returning CashASAP customer, you could borrow up to £750.

If applying for their payday loan product, you could borrow between £200 and £300.

If you need to borrow a larger sum of money, CashLady makes it possible to search for a loan up to £10,000.

Before you search for a loan, you should work out exactly how much money you need to cover your expense. You should never borrow more money than you need or can afford to repay.

What repayment terms are offered by CashASAP?

You can repay a CashASAP multi month loan across a term of 3 to 6 months.

The payday loan option must be repaid within a month; typically, on your next pay date.

There are advantages and disadvantages to loans with shorter repayment terms. While you’ll pay less in interest across a shorter term, your monthly repayments will be higher.

A longer term will cost more in interest, but you’ll have the opportunity to spread the cost of borrowing, which could help to make the loan more manageable for you.

If you’re looking for a loan with a longer term, CashLady could help. The lenders on our panel offer loans with repayment terms from 3 to 60 months, depending on the amount of money you apply to borrow.

Who can apply for a loan with CashASAP?

CashASAP states that to be eligible to apply for a loan with them, you must:

- Be at least 18 years of age;

- Be in full or part-time employment;

- Be a UK resident; and

- Have a UK bank account with a linked debit card.

How quickly could CashASAP send my money?

If your application for a loan with CashASAP is successful, your money could be sent the same day. However, it’s important to understand that this doesn’t necessarily mean that the funds will be available to you the same day. The time it takes for the money to appear in your account will depend on your bank’s policies and procedures.

If you’re shopping around for a suitable loan, it’s worth noting that CashASAP isn’t the only lender that could offer a same-day payout. A number of the lenders on the CashLady panel could also send money to successful applicants on the same day.*

Could I repay my CashASAP loan early?

Yes, you can repay your CashASAP loan early without incurring any fees.

Direct lender vs credit broker

When you apply for a loan directly with a lender, they’re only able to check your eligibility for their product(s).

If the loan isn’t suitable, you may make multiple applications with numerous direct lenders until you find a solution.

This could be an issue if every time you apply for a loan with a direct lender, a hard search is carried out. Undergoing multiple hard searches in a short period of time will damage your credit score, which in turn could limit your borrowing options.

Because of this, many borrowers choose to search for a loan through a credit broker instead.

CashASAP loan alternative

CashLady is a credit broker, and we work with a panel of over 30 direct lenders, all of whom are authorised and regulated by the FCA.

We could help save you time and protect your credit score from multiple hard searches.

CashLady uses soft search technology without impacting your credit score or leaving a visible footprint on your credit file.**

Whatever your credit score, if you meet our eligibility criteria, we’re able to search our panel of lenders for a loan that could be an ideal match for your personal circumstances.

Could I search for a loan with CashLady?

Looking for an alternative to CashASAP loans? You’re welcome to search for a loan with CashLady if you:

- Are over the age of 18;

- Are a UK resident;

- Have a UK bank account and a valid debit card; and

- Have a regular source of income paid into your bank account.

Any credit score considered.

Could I get a payday loan with CashLady?

No, CashLady does not work with any lenders of payday loans. The lenders on our panel provide short-term loans with a range of repayment terms.

Summary: CashASAP v CashLady

| CashASAP | CashLady |

|---|---|

| Direct lender. | Credit broker. |

| When you apply for a loan with CashASAP, they will complete a creditworthiness assessment, which will include a hard search or Open Banking. A hard search will be visible on your credit file for up to 12 months, and multiple hard searches in a short period of time will negatively impact your credit score. | CashLady uses soft search technology. Searching for a loan will not harm your credit score or show on your credit file.** |

| Can check your eligibility for their loan product(s) only. | Can scan a panel of over 30 direct lenders to search for a suitable match for you. |

| Offer payday and short-term loans. | Works with lenders who offer short-term loans only. |

| CashASAP’s multi month option provides loans between £200 and £400 for new customers, and up to £750 for returning customers.

Their payday loan product provides amounts from £200 - £300. |

Could help you search for a loan between £100 and £10,000. |

| Repayment terms from 1 to 6 months on multi month loans and one month for payday loans. | The lenders on our panel offer repayment terms from 3 to 60 months, depending on the amount of money you apply to borrow. |

| Authorised and regulated by the FCA. | We only work with lenders authorised and regulated by the FCA. |

| If your application is successful, your money could be sent the same day.* | Several of the lenders on the CashLady panel could send your money on the same day your application is approved.* |

What to do if you’re worried about money

If you’re concerned about money and debt, please consider taking advantage of the free, confidential support offered by the following charities and organisations: StepChange, MoneyHelper, Citizens Advice, and National Debtline.

*The time it takes for the money to become available in your account will depend on your bank’s policies and procedures.

**If you’re matched with a loan through CashLady and make a full application with the lender, a creditworthiness assessment will be carried out by the lender, which will involve a hard search or Open Banking. A hard search will be visible on your credit file for up to 12 months, and multiple hard searches in a short space of time will damage your credit score.

CashLady Representative 79.5% APR