Who was Dot Dot Loans?

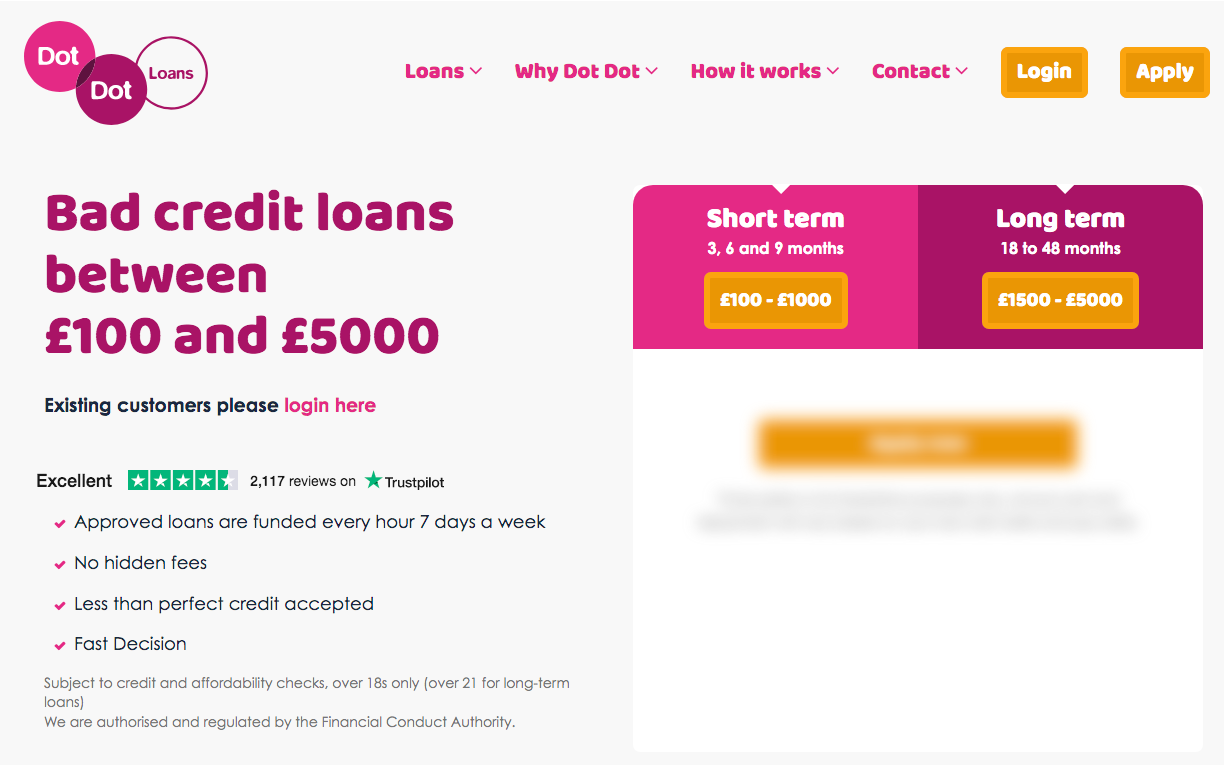

Launched in 2017, Dot Dot Loans was a direct lender of short-term loans, based in Nottingham, UK.

Is Dot Dot Loans still trading?

No, Dot Dot Loans, the direct lender, is no longer trading.

What happened to Dot Dot Loans?

Dot Dot Loans was a trading name of Shelby Finance, owned by Morses Club Limited.

In May 2023, following a number of affordability complaints from customers, Morses Club Limited entered a Scheme of Arrangement.

Despite the Scheme of Arrangement, Morses Club was unable to refinance its debts and ceased trading in November 2023, with Ed Boyle and Robert Spence of Interpath Ltd appointed as joint administrators.

Can I still make a claim against Dot Dot Loans?

No, it’s no longer possible to make a claim against Dot Dot Loans.

CashLady v Dot Dot Loans

If you’re interested in alternatives to Dot Dot Loans, CashLady could be an option to consider.

| Dot Dot Loans | CashLady |

|---|---|

| Was a direct lender. | Is a credit broker. |

| Entered into administration in November 2023 and is therefore unable to accept new credit applications. | The 30+ direct lenders we work with are all actively trading and accepting applications. |

| Offered loans between £100 and £1,000. | The lenders on our panel provide loans from £100 to £10,000. |

| Dot Dot Loans customers had the opportunity to repay their loan over terms of 3 to 9 months. | Depending on the amount of money you apply to borrow, you could choose a repayment term between 3 and 60 months. |

| As a direct lender, Dot Dot Loans would have carried out a creditworthiness assessment on all potential applicants, which would have included a hard search or Open Banking. A hard search will remain on your credit file for up to 12 months, and multiple hard searches in a short space of time will harm your credit score. | You can search for a loan with CashLady without affecting your credit score.

CashLady uses soft search technology to look for a suitable loan for you. A soft search will not be visible on your credit file and will not affect your credit score.* |

| Dot Dot Loans were able to process approved loans every hour, 24/7. | Some of the lenders on the CashLady panel could send your money on the same day as your application is approved.**

Our online form is available 24 hours a day, 7 days a week. |

| People with less-than-perfect credit history were welcome to apply with Dot Dot Loans. | CashLady works with several lenders who specialise in loans for people with bad credit. |

Who can search for a loan with CashLady?

You can search for a loan with CashLady if you:

- Are over the age of 18;

- Are a UK resident;

- Have a UK bank account and a valid debit card; and

- Have a regular source of income paid into your bank account.

CashLady: a Dot Dot Loans alternative

Six reasons to choose CashLady as your Dot Dot Loans alternative.

1. Using a credit broker, like CashLady, could save you time. Rather than approaching one lender at a time, we can present your application to over 30 lenders at the same time to help you search for a suitable match.

2. Our credit broking service is free to use.

3. Once you’ve filled out our five-minute online form, you can get your no-obligation quote in just 60 seconds.

4. CashLady only works with lenders who are authorised and regulated by the Financial Conduct Authority (FCA).

5. Several of the lenders on our panel are willing to consider applications from people with bad credit.

6. If your application is approved by one of our lenders, your money could be sent the same day.**

Are you worried about money or concerned about your level of debt?

Please know that the following websites provide free, impartial money and debt support: MoneyHelper, Citizens Advice, and National Debtline.

If you’re not sure where to start, you might find this free Money Health Check quiz useful. The quiz, put together by CashLady and charity StepChange, takes just a couple of minutes to complete, and can offer advice on the next steps to take in your journey towards regaining financial confidence.

*If you’re matched with a loan and choose to make a full application directly with the lender, they will conduct a creditworthiness assessment, which will involve a hard search or Open Banking. A hard search will be visible on your credit file for up to 12 months, and multiple hard searches in a short period will damage your credit score.

**Payout timescales vary between lenders. The time it takes for the money to become available in your account will depend on your bank’s policies and procedures.