CashLady as your Morses Club alternative

None of the lenders on the CashLady panel offer doorstep loans; however, they do offer short-term, personal loans with repayment terms from 3 to 60 months, depending on how much money you apply to borrow.

- Search for a loan between £100 and £10,000.

- Your money could be sent the same day your application is approved.*

- Our credit broking service is free to use.

- No-obligation quotes.

- CashLady, and all the lenders we work with, are authorised and regulated by the Financial Conduct Authority (FCA).

*The time it takes for the money to become available in your account will depend on your bank’s policies and procedures.

CashLady Representative 79.5% APR

What was Morses Club?

Morses Club was a UK-based direct lender of doorstep loans.

Morses Club had rather a long history, having started out as a general drapery store in Swindon over 130 years ago. The owner, Mr Levi Morse, expanded his business and took on several department stores. As the popularity of his stores grew, Mr Morse employed a number of staff to travel around the surrounding areas and knock on doors to sell goods to people on weekly credit.

Eventually, these early practises laid the foundations for the company Morses Club would become. After Provident – a lender with a similar borrowing arrangement - ceased trading in 2021, Morses Club was considered to be the largest doorstep lender in the UK.

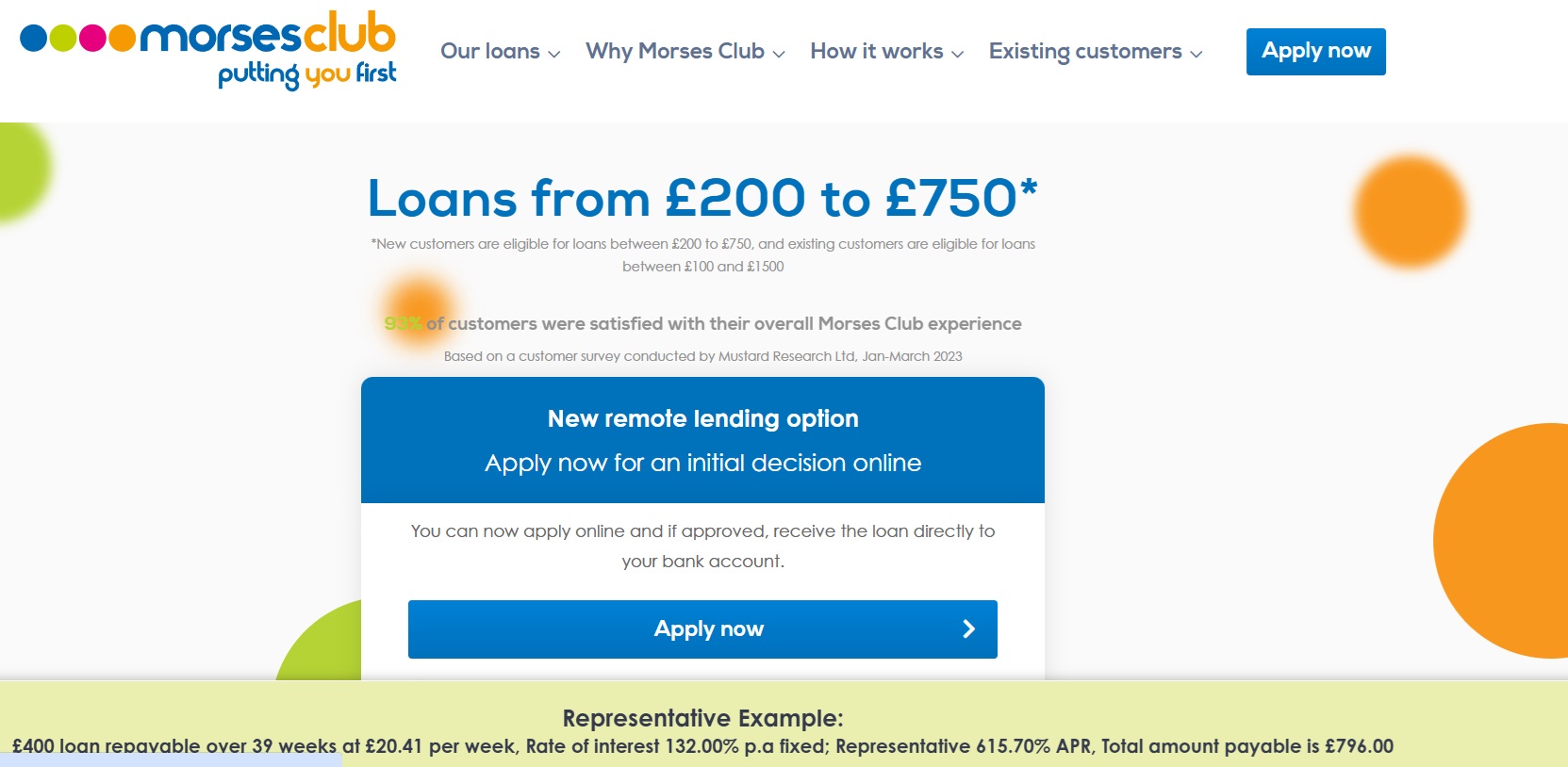

New customers were able to apply for loans between £200 and £750, and existing customers could apply to borrow from £100 to £1,500. Morses Club charged higher rates of interest on their loans than mainstream lenders. The annual percentage rate (APR) on a one-year loan was 343%.

What happened to Morses Club?

Morses Club went into administration on November 17, 2023, following a turbulent few years during which they were forced to refund customers who had been approved for loans they later claimed were unaffordable.

The following statement was posted on the Morses Club website:

“Morses Club has been under sustained financial pressure for some time, a situation which was exacerbated in recent years by it facing a significant number of customer redress claims.”

In May 2023, Morses Club started a Scheme of Arrangement, which they hoped would cap the amount of money they were required to pay in refunds.

Despite this, Morses Club were unable to refinance their debts. The scheme was terminated, and Ed Boyle and Rob Spence of Interpath Ltd were appointed as Joint Administrators.

I was a Morses Club customer; what happens to my existing loan with them?

In March 2024, the administrators sold a number of loans to debt-collection company, Lantern. Any loans that were not handed over to Lantern were written off. In addition to this, the Morses Club contact centre was also closed, meaning that as of March 2024, the Morses team are no longer able to take phone calls or respond to emails.

Those who received an email stating that their loan had been paid off will no longer be required to make repayments.

Anyone who has had their outstanding loan assigned to Lantern should have received communication advising them of the next steps.

Is Morses Club still doing loans?

No, it’s no longer possible to get a loan from Morses Club; however, if you’re searching for a loan, there are a number of other active credit brokers and lenders who could help you, including CashLady.

Who can use CashLady to search for a loan?

You can search for a loan using the CashLady credit broking service if you:

- Are over the age of 18;

- Have a UK address;

- Have a UK bank account with a valid debit card; and

- Have a regular income paid directly into your bank account.

I have bad credit; can I still use CashLady to search for a loan?

A number of the lenders on the CashLady panel specialise in loans for people with poor credit history, so while getting approved for a loan when you have bad credit can be difficult, CashLady might be able to find you a lender willing to consider your application.

A bad credit loan is likely to come with a higher interest rate – before you apply, you should ensure that you can comfortably afford the monthly repayments without this affecting any of your essential outgoings, like mortgage or rent, food, and utilities.

The CashLady process

The CashLady credit broking process is straightforward. Our online form should take no longer than five minutes to complete and can be done at a time and place that suits you, 24 hours a day, 7 days a week.

1. Let us know how much money you need to borrow and how long you’d like to borrow it for.

2. Using the information you’ve provided, we’ll run a soft search with no impact to your credit score** and search our panel of lenders for an appropriate match. This stage should take around 60 seconds.

3. If we’ve found you a loan, you’ll be redirected to the lender’s website, where you’ll be able to find out more about both the loan and the lender.

4. If you’re happy to go ahead with the loan, you will be required to make a full application directly with the lender. At this stage, the lender will carry out a hard credit search.

5. If the lender is happy with the outcome of their checks, you’ll be sent a loan agreement. You should take the time to read through this carefully before deciding whether you’d like to sign and return it.

**CashLady uses soft search technology, which will not affect your credit score. If you choose to make a full application for a loan directly with the lender, a hard search will be carried out by that company. A hard search will remain visible on your credit file for up to 12 months. Multiple hard searches within a short period of time could have a negative impact on your credit score.

What happens if I can no longer afford my repayments?

If you’ve taken out a loan that you can no longer afford to repay, you should contact your lender as soon as you can.

Your lender will talk you through any options that may be available to help alleviate some of the pressure.

Very few of us feel comfortable talking about money, especially when we’re struggling financially, but please know that reaching out is the first step towards taking back control, putting a plan in place, and getting your confidence back.

Money worries? Help is available.

If you’re experiencing money or debt worries, please know that you can access free, confidential advice through charities and organisations such as StepChange, MoneyHelper, Citizens Advice, and National Debtline.

Information correct as of November 2024.

The information contained in this article is a general guide and is not intended nor should be understood as advice.