LoanPig loan alternatives: CashLady

If you’re looking for an alternative to a LoanPig loan, CashLady could help you search.

We’re a credit broker, working with a panel of direct lenders who offer short-term personal loans from £100 to £10,000.

CashLady and all the lenders we work with are authorised and regulated by the FCA.

Worried about your credit score? CashLady is proud to work with a number of lenders who specialise in loans for people with bad credit, and they could be willing to consider your application.

Our online form takes just five minutes to complete, and in just 60 seconds, we’ll reveal whether we’ve been able to match you with a loan to suit your financial situation.

CashLady Representative 79.5% APR

How much money could I get with LoanPig?

With LoanPig, you could apply to borrow between £50 and £1,500.

Before you search for a loan, you should work out exactly how much money you need. You should never apply for more money than you need or can afford to repay.

If you need to borrow more than £1,500, you might consider searching with CashLady instead. As discussed, the lenders on our panel offer loans up to £10,000.

What sort of repayment terms does LoanPig offer?

You could repay your LoanPig loan over a period of 1 to 12 months.

Need more time? Choose CashLady to help you search for a loan instead.

With CashLady, you can search for a loan with a repayment term from 3 to 60 months, depending on the amount of money you apply to borrow.

What sort of interest is applied to the loan?

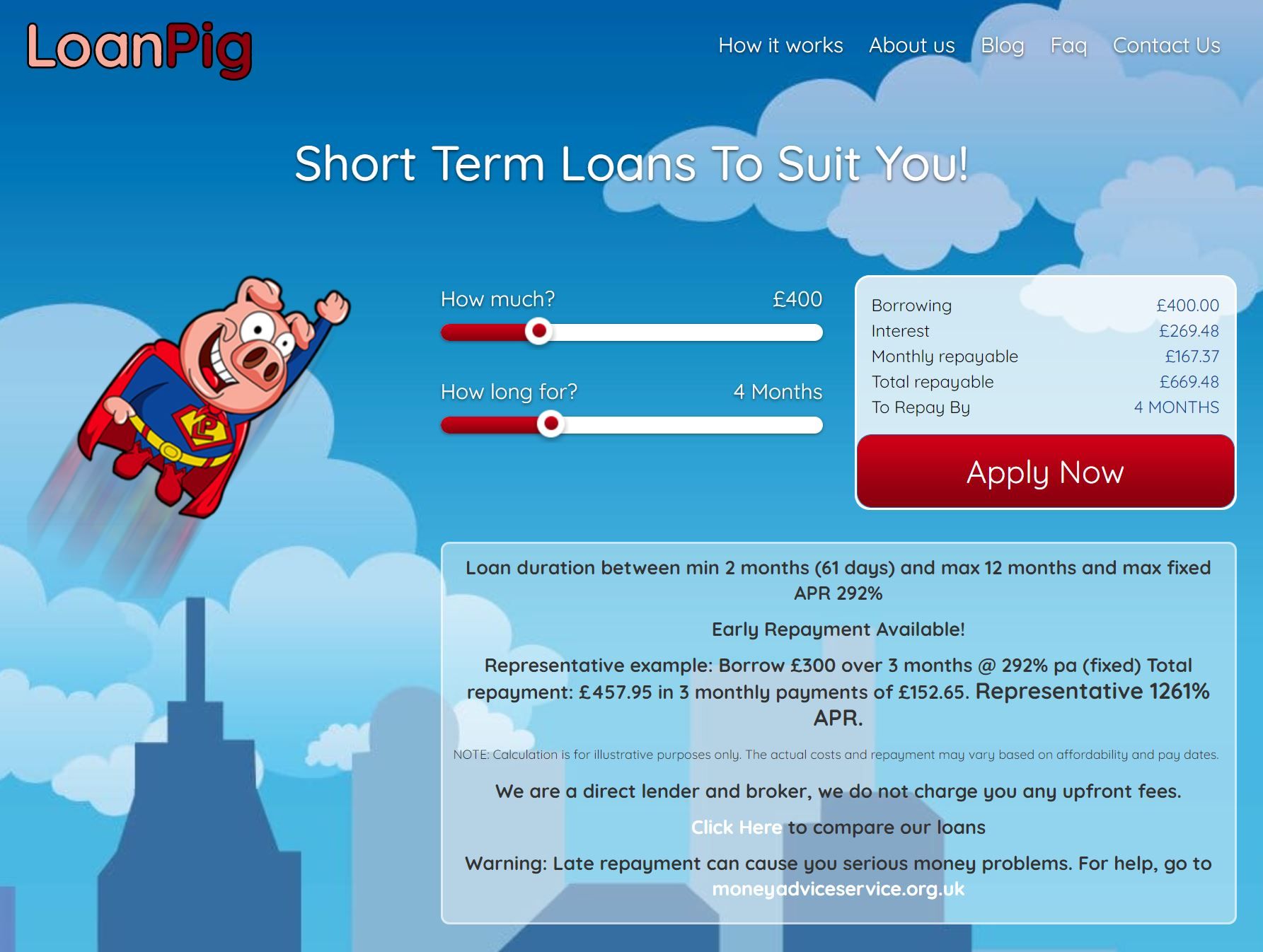

LoanPig provide the following representative example on their website:

Borrow £300 over 3 months @ 0.8% per day. Total repayment: £457.95 in 3 monthly payments of £152.65. Representative 1261% APR.

Can I repay my LoanPig loan early?

Loans that have been approved and paid out directly by LoanPig can be repaid early with no fee or penalty.

If you’re approved for a loan through LoanPig’s credit broking service, you’ll find information on early repayments in your loan agreement, which will have been sent to you during the initial application process.

Does LoanPig charge late repayment fees?

If you miss or make a late repayment on your LoanPig direct lender loan, you could be charged a £15 fee, plus added interest of 0.8% per day.

Again, if your loan was obtained through LoanPig’s credit broking service, you’ll need to consult your credit agreement or reach out to your lender.

Where can I find LoanPig reviews?

You can browse LoanPig customer reviews on their Trustpilot page. As of November 2025, LoanPig is rated ‘Average’ on Trustpilot, with an average score of 3.3/5.

Who can apply for a loan with LoanPig?

You can apply for a loan with LoanPig if you:

- Are over the age of 18;

- Are a UK resident;

- Are employed;* and

- Meet the affordability and credit checks set by LoanPig and their lenders.

*LoanPig states that in some circumstances, other forms of income may be considered.

If you’re interested in searching for a loan with CashLady instead, you must:

- Be over the age of 18;

- Be a UK resident;

- Have a UK bank account and a valid debit card; and

- Have a regular source of income paid into your bank account.

How does the CashLady application process work?

We’ve broken the CashLady journey down into four simple steps:

1. Select your loan amount and preferred repayment term.

2. Complete our online form. We’ll then try to match you with a suitable short-term loan provider from our panel.

3. If a match has been found, you’ll be redirected to the lender’s website where you can decide whether you’d like to make a full application. At this stage, a creditworthiness assessment will be carried out by the lender, and this will include a hard search or Open Banking. A hard search will remain on your credit file for up to 12 months, and multiple hard searches in a short space of time will harm your credit score.

4. If your creditworthiness assessment is successful, you’ll be formally offered the loan and told when you can expect the money to be sent to your bank account.

During the application process, your lender will send you a credit agreement, which you should read through thoroughly and carefully. Remember, your loan quote is no obligation, so you do not need to go ahead with the loan if you’re not 100% happy with your offer.

LoanPig summary

LoanPig is both a credit broker and direct lender for short-term and payday loans aimed at borrowers who need help dealing with an unexpected financial emergency.

Customers can search for a loan between £50 and £1,500 over a period between 1 to 12 months.

LoanPig can be contacted via email at info@loanpig.co.uk or by completing the form on their 'contact us' page.

You can also contact them in writing at the following address:

The Money Hive Limited

657 Liverpool Road

Manchester

M44 5XD

Free, financial help

If you’re worried about money, please consider reaching out to one of the following organisations: StepChange, MoneyHelper, Citizens Advice, or National Debtline.