Who is Creditspring?

Creditspring is a direct lender based in London, UK, and aims to provide ‘flexible, efficient borrowing’.

Creditspring is a trading name of Inclusive Finance Limited and is authorised and regulated by the Financial Conduct Authority (FCA).

Creditspring reviews

As of November 2025, Creditspring is rated ‘Excellent’ on Trustpilot. Creditspring has over 21,000 customer reviews, and 92% of these are 5*.

What type of loans are available with Creditspring?

Creditspring has a unique offering for its customers, which allows them to access two interest-free loans per year with a Creditspring membership.

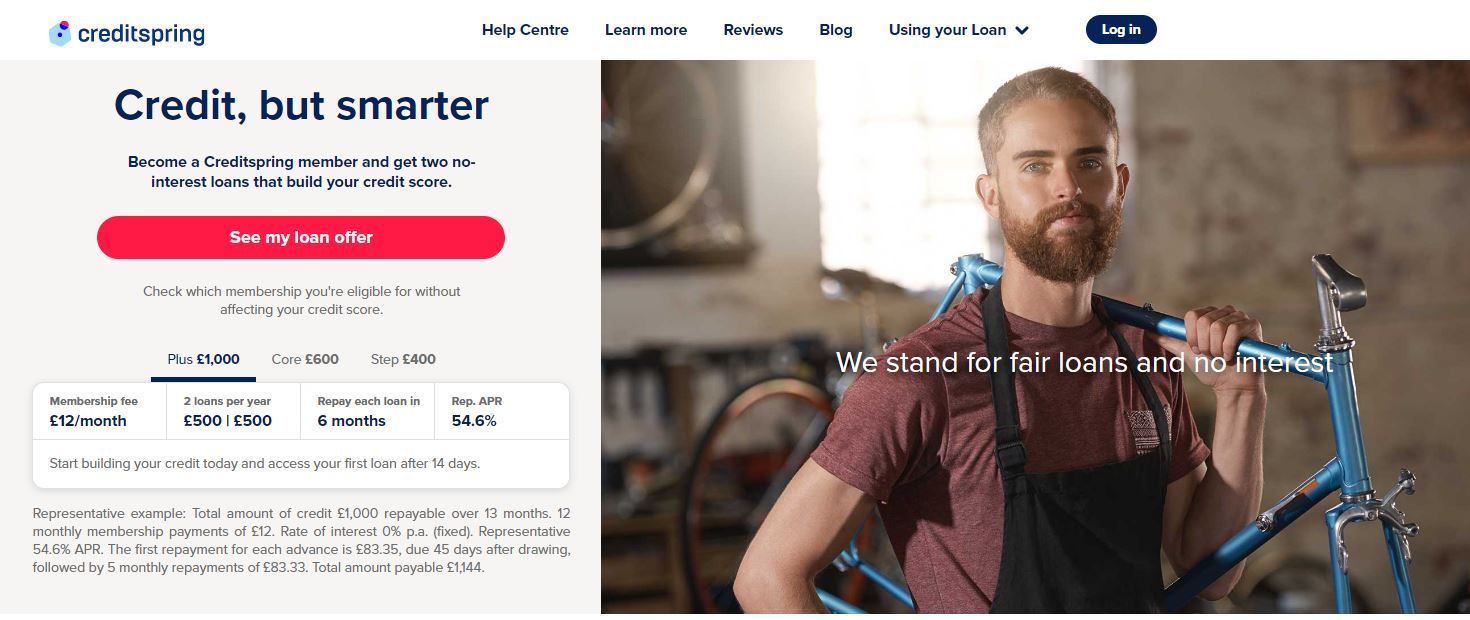

Creditspring customers pay a monthly membership fee, which varies depending on the chosen tier. The membership tier defines how much can be borrowed each year. This is illustrated below:

- Step Membership: £7 monthly fee. Borrow 2 x £200 loans per year.

- Core Membership: £10 monthly fee. Borrow 2 x £300 loans per year.

- Plus Membership: £14 monthly fee. Borrow 2 x £500 loans per year.

- Extra Membership: £26 monthly fee. Borrow 2 x £1,200 loans per year.

How much interest does Creditspring charge?

Each of the two loans per year offered by Creditspring is interest-free. However, Creditspring customers must also pay a monthly membership fee on top of any loan repayments due.

- Step Membership: Representative 88.8% representative APR

- Core Membership: Representative 83.1% representative APR

- Plus Membership: Representative 66.2% representative APR

- Extra Membership: Representative 48.1% representative APR

Creditspring representative example: Total amount of credit £600 repayable. 12 monthly membership fees of £10. Rate of interest 0% p.a. (fixed). Total cost of credit: £120. Total amount payable: £720. Monthly loan payment: £50. Representative 83.1% APR

What length of loan term does Creditspring offer?

Creditspring only offers loans over a six-month period. Please bear in mind that the greater the loan amount, the higher the monthly repayments will be.

You should never apply to borrow more money than you need or can afford to repay.

Can I repay my Creditspring loan early?

Yes, you can repay your loan in full before the end of the six-month term if you wish to do so. You can do this by logging into your Creditspring account and selecting the ‘repay early’ option.

Who could be eligible to borrow with Creditspring?

Typically, to be considered by Creditspring, you must:

- Be over the age of 18;

- Have a UK bank account that has been open for longer than 3 months;

- Earn a minimum of £14,000 a year; and

- Have no recent bankruptcies, county court judgements (CCJs), or Individual Voluntary Arrangements (IVAs).

You can use Creditspring’s free eligibility checker to see which tier of membership you could be eligible for. The membership will determine the loan amount which you could borrow.

Could I get a Creditspring loan with bad credit?

Creditspring is just one of the lenders on the CashLady panel who is willing to consider applications from people with a history of bad credit.

Does Creditspring charge a late repayment fee?

Creditspring does not charge late fees, but urges any customers who are worried about an upcoming payment to contact them at least five days before their scheduled repayment date. Creditspring will work with you to decide the next steps and put a plan in place to suit both parties.

If your membership fee or loan is paid late, or your repayment is missed altogether and Creditspring aren’t aware of your situation, this will be reported to the credit reference agencies (CRAs). This will negatively impact your credit score, which could affect your ability to borrow money in the future if you need to.

Contact Creditspring

If you have a question, you might find it useful to browse the information at Creditspring’s Help Centre. If you’re unable to find the answers you need, you can contact Creditspring in the following ways -

- By phone: 020 3870 3332*

- Via the Live Chat feature on your customer account.

*Creditspring’s customer contact centre is open from Monday to Friday between the hours of 9am to 5pm.

Creditspring summary

- Creditspring is a direct lender offering different types of membership, which enables customers to access a loan of a set amount twice a year.

- A membership fee will be charged monthly.

- Creditspring loans are interest-free; however, customers will be charged a monthly membership fee.

- Repay your Creditspring loan over a 6-month term.

- No fees for early repayment.

- Creditspring is a trading name of Inclusive Finance Limited and is authorised and regulated by the FCA.

- As of June 2025, Creditspring is rated ‘Excellent’ on Trustpilot.

Struggling with debt?

If you’re experiencing money problems or are worried about your level of debt, please consider reaching out to any of the following charities and organisations: StepChange, MoneyHelper, Citizens Advice, and National Debtline.

CashLady Representative 79.5% APR