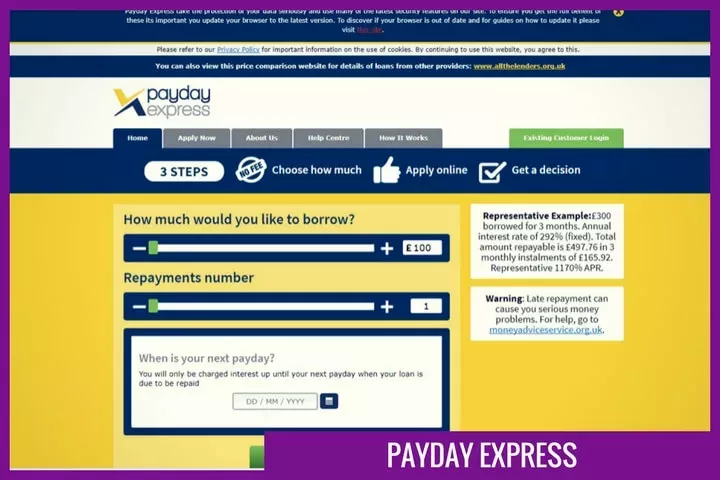

Who was Payday Express?

Payday Express was a direct lender offering payday loans in the UK.

What happened to Payday Express?

Payday Express was a trading name of Instant Cash Loans Limited and stopped offering loans in October 2017.

In October 2019, Instant Cash Loans Limited entered into a scheme of arrangement with plans to close down the company. This meant that its various trading names, including Payday Express, Payday UK, and The Money Shop, also ceased trading.

Can I still apply for a loan with Payday Express?

No. Payday Express is no longer trading, and it’s not possible to make an application for a loan with them.

Can I still apply for a payday loan?

You could still apply for a payday loan in the UK, but you might not find as many lenders offering this type of loan nowadays.

In 2015, the FCA brought in new rules for high-cost short-term borrowing. These rules were put in place to protect borrowers and make lending both fairer and more affordable.

Many payday lenders were hit with complaints from customers claiming they’d been offered unsuitable and unaffordable loans. A number of these payday loan companies, including giants such as Amigo and Wonga, collapsed.

The popularity of payday loans declined, with many consumers choosing a short-term loan instead, which allows borrowers to spread the cost of borrowing over a longer period than the traditional payday loan repayment term of just one month.

Payday Express alternatives

CashLady is a credit broker, working with a large panel of FCA authorised and regulated lenders.

The lenders we work with offer short-term loans which can be repaid over 3 to 60 months, depending on the amount of money you apply to borrow. You can search for a loan between £100 and £10,000.

The CashLady eligibility criteria

You’re welcome to use CashLady’s credit broking service if you:

- Are over the age of 18;

- Are a UK resident;

- Have a UK bank account and a valid debit card; and

- Have a regular source of income paid into your bank account.

Search for a loan with CashLady

Searching for a short-term loan with CashLady is straightforward. Our online form can be accessed 24 hours a day, 7 days a week, and should only take around 5 minutes to complete.

1. Fill out our online form. Tell us some key information about you, as well as letting us know how much money you need to borrow, and for how long.

2. Next, we’ll run a soft search and scan our panel of lenders for a suitable loan for you. This should take no longer than 60 seconds.

3. If you’ve been matched with one of our lenders, you’ll be redirected to their website. If you’d like to make a full application for the loan, the lender will carry out a creditworthiness assessment, which will involve a hard search or Open Banking.*

4. If you pass the lender’s checks, the loan will officially be offered to you. Some of the lenders on the CashLady panel could send your money on the same day as your application is approved, although please note that the time it takes for the money to become available in your account will depend on your bank’s policies and procedures.

You’ll be sent a credit agreement at some point during your application with the direct lender. The stage at which you’ll receive this varies between lenders. It’s important to take your time reading through all the details in your agreement before you decide whether to sign and return it.

Payday loans with no credit check in the UK

In the UK, it’s not possible to get a payday loan – or any other type of loan - from a safe and reputable lender without undergoing a full credit check, otherwise known as a creditworthiness assessment.

All FCA authorised and regulated lenders must complete a creditworthiness assessment before they’re able to offer you a loan.

These checks are in place to ensure that you can afford to pay back the money you borrow without causing unnecessary financial stress or debt.

You could still get a loan, even with bad credit

Are you dealing with a financial emergency?

Are you worried that a history of bad credit could stand in your way when searching for a loan?

Please know that bad credit doesn’t automatically mean that your loan application will be turned down.

A handful of lenders on the CashLady panel specialise in loans for people with bad credit, and they could be willing to consider your application.

Many lenders use Open Banking as part of their creditworthiness assessment.

Open Banking is a procedure carried out by an authorised third party, such as a lender. With your consent, this safe and secure process enables your chosen lender to access your online bank account and view your recent financial transactions. Rather than relying on a hard search and your credit score, Open Banking allows lenders to gain recent insight into your financial habits. This could be especially useful for those who have made errors in the past but are now on top of their finances.

Important: while a bad credit loan could be a real lifeline in the event of an unexpected expense, please bear in mind that you could be offered a higher rate of interest. You should take the time to consider how this will affect your monthly repayments and the cost of borrowing.

I can’t afford my monthly repayments; what are my options?

If you find yourself in this position, your lender will be able to discuss any options that might be available. You should reach out to your lender as soon as you can.

Please try not to panic. If you’re worried about money, any of the following sites could help you: StepChange, MoneyHelper, Citizens Advice, and National Debtline.

Each of these organisations offers free, impartial and confidential advice to anyone who is struggling with money and/or debt.

*A hard search will remain on your credit file for up to 12 months. Undergoing multiple hard searches within a short period will harm your credit score.

CashLady Representative 79.5% APR