What is the duration of a PaydayUK loan?

Between one to 12 months.

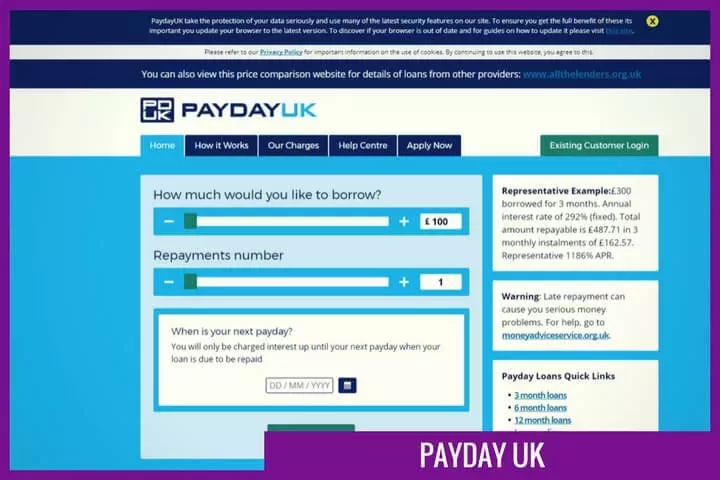

How much credit can you apply for?

You may apply to borrow between £100 - £2000. Before applying, run your preferred loan amount through the online loan calculator on the PaydayUK homepage. This shows the expected full cost of the loan, based on how much you want to borrow, and for how long, helping ensure that you borrow only what you can comfortably afford.

What is PaydayUK's loan application process?

First use the online calculator to select your ideal loan amount and duration and then click, ‘Apply Now’. Complete the simple online form, providing personal information, including an address history, information on your income and expenditure, along with bank details.

If approved you are offered up to five different loan options and once you have selected your offer, are required to provide your debit card details.

Your loan documents are sent to the email address provided on the application, which you need to read this carefully, and then electronically sign it if you are happy to proceed.

CashLady Representative 79.5% APR

What are the requirements?

To apply for a loan from PaydayUK you should:

How quickly will I receive my loan from PaydayUK?

New customers are required to submit their application form before 3 pm for the same day deposit. Deposit times run 4 am to midnight, on the hour, every day.If your bank doesn’t support Faster Payments then it may take longer to receive your loan funds.

What do PaydayUK charge?

The cost of your loan is dependent on the amount that you borrow and for how long. Daily interest rates range from 0.36% to 0.8%, dependent on the duration of your loan, which means you will pay between 36p to 80p per day per £100 borrowed.

How much will you repay?

Representative Example

£300 borrowed for 3 months. Annual interest rate of 292% (fixed). Total amount repayable is £487.71 in 3 monthly instalments of £162.57. Representative 1186% APR.

Do PaydayUK charge penalties?

There are no hidden charges or upfront costs, and no fees for late or missed repayments. However non-repayment may result in PaydayUK notifying the credit reference agencies, which can negatively impact your credit score and ability to gain credit in the future.

If you are having problems making a payment, call their customer care team on 0330 024 1642 to discuss your payment options

Can I repay my PaydayUK loan early?

You may repay early by calling 0330 024 1642 or logging into your online account. Interest is charged by the day, and so settling your loan early will reduce the overall amount you are required to pay back.

Will PaydayUK run a credit check?

PaydayUK will run a credit check as part of your loan application process, along with assessing your current financial situation and loan affordability. They look at each application based on recent financial and personal circumstances, meaning that you may still receive a loan even you have less than perfect credit.

What help and support do PaydayUK offer?

PaydayUK customer support is available Monday to Friday, 8 am to 7 pm, on Saturdays, 9 am to 4 pm, and 10 am to 4 pm on bank holidays (excluding Christmas Day, Boxing Day and New Year's Day.) Contact them by telephone on 0330 024 1642or email account.services@paydaycontact.co.uk.

Where can you find online reviews of PaydayUK?

PaydayUK works with business review platform TrustPilot, to provide genuine customer reviews on their loans and customer service experience. There’s currently over 3,400 reviews on the site, rating the lender an average 9.3 out of 10.

What are PaydayUK's FCA registration details?

PaydayUK is a trading name of Instant Cash Loans Limited who are authorised and regulated by the Financial Conduct Authority, under registration number 681750 on the Financial Services Register.

Applying with CashLady

Applying through Cashlady involves just one application. We’ll then bring you a selection of suitable quotes from various lenders, including PaydayUK.

We use our in-depth knowledge of the market, plus a portfolio of over 15 loan providers, to match you with the perfect loan and loan provider.

We’ll supply all the relevant rates and prices, repayment terms and other important details that will help you to compare loan options, so you can make the decision that is right for you.

Here’s a useful comparison table, highlighting some of the differences when you apply with CashLady:

| Cash Lady | PaydayUK | |

|---|---|---|

| Representative APR% | 1272% | 1186% |

| Loan Duration | Up to 12 months | Up to 12 months |

| Repay Early | Yes | Yes |

| Panel of Lenders? | Yes | No |

| Loan Options (Number of Lenders) | 15 | 1 |

How to contact PaydayUK

Telephone

0330 024 1642

account.services@paydaycontact.co.uk

Registered Address

6 Bevis Marks

London

EC3A 7BA

Last Updated: 2nd July 2024