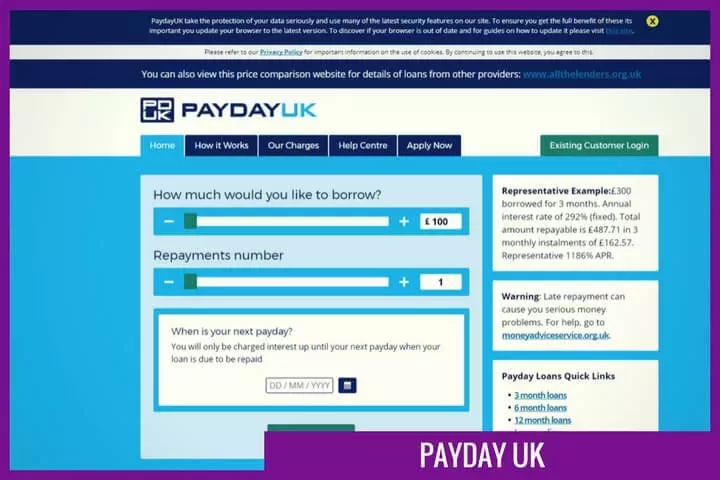

What happened to Payday UK?

Payday UK was a UK-based direct lender of payday loans and a trading name of Instant Cash Loans Limited, which entered into a scheme of arrangement on October 9, 2019.

Payday UK stopped accepting applications for loans in October 2017, two years before the scheme of arrangement.

Instant Cash Loans Limited was established in 1992 and also owned a number of other payday loan companies, such as Payday Express and The Money Shop.

As a result of the scheme of arrangement, all brands under the Instant Cash Loans Limited umbrella ceased trading.

Can I still apply for a loan with Payday UK?

Unfortunately, due to the fact that the company is no longer operating, it’s not possible to apply for a payday loan with Payday UK.

I’m looking for a loan; are there any alternatives to Payday UK loans?

If you’re looking for a Payday UK loan alternative, CashLady could help you search.

Here are six reasons why you may wish to consider CashLady to help you look for your Payday UK loans alternative:

1. Let us take the stress out of trying to find the right lender for you. We’re a credit broker, working with over 30 direct lenders. When you submit an application, we’re able to scan our large panel of lenders to search for the most suitable short-term loan for you, based on your personal situation.

2. Our lenders offer a choice of loan amounts and repayment terms. If eligible, you could search for a loan between £100 and £10,000, with repayment terms across 3 to 60 months, depending on the amount of money you apply to borrow.

3. We only work with lenders who are authorised and regulated by the FCA.

4. Our service is free to use. You can use our credit broking service to help you search for a loan without being charged any fees.

5. We understand that financial emergencies can happen at any time, which is why our website is available 24 hours a day, 7 days a week.*

6. If your loan application is approved by one of our lenders, your money could be sent the same day.**

The CashLady eligibility criteria

You can search for a loan with CashLady if you:

- Are over the age of 18;

- Are a UK resident;

- Have a UK bank account and a valid debit card; and

- Have a regular source of income paid into your bank account.

Worried that bad credit could hold you back? CashLady works with several lenders who specialise in loans for people with bad credit, and they could be willing to consider your application. Please note that a bad credit loan could come with a higher rate of interest.

Do payday loans still exist in the UK?

In 2015, the Financial Conduct Authority (FCA) introduced new guidelines to make short-term-high-cost borrowing more affordable and fairer for customers.

Following the collapse of several big-name payday loan companies, including Instant Cash Loans, it’s thought that there are fewer payday loan providers than there were 10 years ago.

It could still be possible to get a payday loan in the UK, although your options may be limited. These days, short-term loans are more common than payday loans in the UK.

Are short-term loans better than payday loans?

No type of loan can be considered ‘better’ than another; this is because everyone’s financial situations are different, and the ‘best’ credit product for you will depend on your circumstances.

Unlike a payday loan, which is typically repaid in full within a month, a short-term loan comes with a range of repayment terms, allowing you to make repayments over several months or years. Spreading the cost of a loan could make it more manageable for your budget.

Worried about money and debt?

Whatever’s on your mind, please know that you can access free, confidential financial support through any of the following organisations: StepChange, MoneyHelper, Citizens Advice, and National Debtline.

*If you apply outside of office hours (Monday-Friday, 9am-5pm), your application may not be processed until the next working day.

**Payout timescales vary between lenders. The time it takes for the money to appear in your account will depend on your bank’s policies and procedures.