Payday loans: a timeline

Early 1980s: payday loans as we know them in the USA

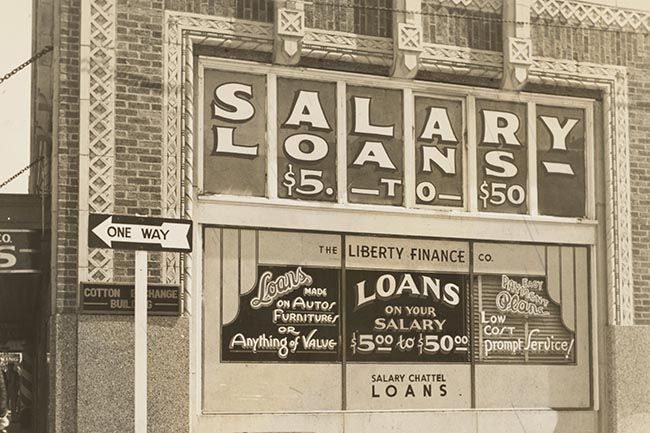

The concept of lending money has been around for centuries; however, it wasn’t until the 1980s that payday loans as we know them first became available in America.

Early 1990s: welcome to the UK, payday loans

High street payday loan providers first arrived in the UK in the early 1990s.

The industry was regulated by the Office of Fair Trading (OFT) until the Financial Conduct Authority (FCA) took over on April 1, 2014.

The mid-00s: the rise of the payday loan

During the mid-00s, payday loans grew in popularity, with many companies setting up shop both on the high street and online. The financial crisis of 2008 is thought to have played a role in the increased demand for this type of lending; during that year, £900m worth of payday loans were approved. In 2009, it’s estimated that 1.2 million people took out a payday loan.

Some of the big-name lenders included Wonga, Amigo, and WageDay Advance.

2014: tighter borrowing restrictions introduced by the FCA

What happened to payday loans in the UK?

In 2014, the FCA introduced new rules for short-term lending in the UK. These rules aimed to protect borrowers from unnecessary financial hardship and make the industry fairer and more transparent.

The rules put in place by the FCA include:

- Customers must not pay back more than double the amount they borrowed in interest and fees.

- Customers making a late or missed repayment cannot be charged more than £15 in default fees.

- Interest and fees must not exceed 0.8% per day of the borrowed amount.

2018: The fall of Wonga and the decline of payday loans

Once the new regulations had been implemented, and fairer and more transparent lending was better understood, many current and former payday loan customers began to question whether they’d been mis-sold credit and overcharged interest. This led to multiple payday loan providers receiving affordability complaints. In the face of mass complaints, many of the affected companies were unable to sustain themselves and entered into administration.

Payday loan giant Wonga collapsed in 2018, with WageDay Advance following suit in 2019, and Uncle Buck, Peachy, and Sunny closing their doors in 2020.

2025: Do payday loans still exist in the UK?

‘Do payday loans still exist?’ is a frequently asked question, and the answer is yes, payday loans do still exist, although they are perhaps not as common as they once were, given the decline of many payday loan providers.

If you’re searching for ‘legit payday loans’, it’s important to make sure that the lender or credit broker you’re applying with is authorised and regulated by the FCA. You can check to see whether a company appears on the FCA register by using the free FCA Firm Checker tool here.

Many borrowers choose a short-term loan so they can spread their repayments over several months, rather than 30 days, making their monthly repayments more manageable.

Payday loans vs short-term loans

A payday loan will typically need to be repaid in full within a month, while a short-term loan comes with a range of repayment terms from several months to years. The repayment terms available to you will depend on the amount of money you apply to borrow.

Could I get a payday loan with CashLady?

CashLady does not work with any payday lenders. Instead, the lenders on our panel offer short-term, personal loans with repayment terms between 3 and 60 months, depending on the amount of money you apply to borrow.

With CashLady, you could apply for a loan from £100 to £10,000.

We’re proud to share that all the lenders on the CashLady panel are authorised and regulated by the FCA.

Search for a payday loan alternative with CashLady

You’re welcome to use CashLady’s free credit broking service to search for a short-term loan if you:

- Are over the age of 18;

- Are a UK resident;

- Have a UK bank account and a valid debit card; and

- Have a regular source of income paid into your bank account.

Our online form takes just five minutes to complete, and quotes are no-obligation.

Worried about money?

If you’ve taken out a loan and you’re finding it difficult to make your repayments, it’s important to speak to your lender as soon as you can. They will be able to offer you advice on what to do next and discuss any available options with you, such as a repayment holiday or temporarily reduced repayments.

You can find free, impartial money and debt management advice on sites such as StepChange, MoneyHelper, Citizens Advice, and National Debtline.