If your credit score is a little worse for wear, you might have dismissed the idea of being considered for a credit card.

Did you know that you could still be eligible for a credit card, even with bad credit?

In fact, some credit cards are specifically designed to help people with bad credit recover their score and work towards a healthier credit position.

You can find more in the CashLady guide to credit cards for people with bad credit.

Check your eligibility now

Check your eligibility now

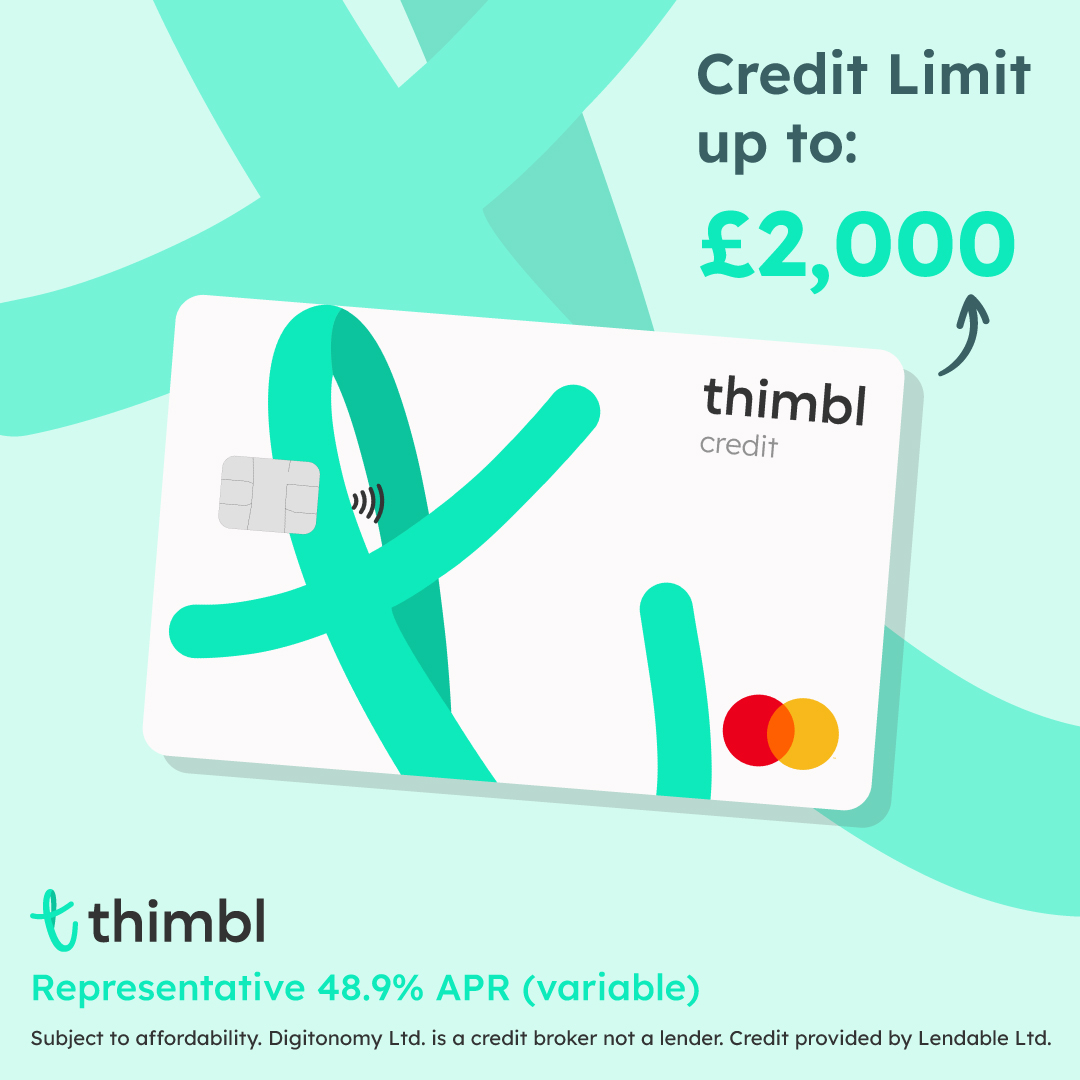

Check in 60 seconds if you could be approved for a thimbl credit card to start building your credit score.

What is a bad credit credit card?

As the name suggests, a bad credit credit card is a type of credit card aimed at people with bad credit. You might also hear this type of product referred to as a credit builder credit card.

A credit builder credit card does exactly what it says on the tin: helps users build up their credit score.

These two types of credit card aren’t just for people with bad credit, either – they could also be a suitable option for people with no or minimal credit history.

How do credit cards for bad credit work?

A credit builder credit card works a little like this:

1. Use your credit card to make a necessary purchase that you can afford to repay.

2. Pay at least the minimum repayment amount due on your credit card. If you repay the full balance on time, you won’t be charged interest.

3. Try to combine responsible credit card use with other credit-building methods, such as paying your bills on time and keeping the information on your credit report up to date.

4. Over time, with positive spending and repayment habits, you could see an improvement in your credit score.

Bad credit history vs no credit history

Bad credit history usually occurs following past mismanagement of credit commitments; for example, a late or missed repayment.

Having no credit history, on the other hand, is common in people who have never paid bills in their name or borrowed credit before.

While bad credit history and no credit history have very different causes, both can produce the same outcome when it comes to applying for credit.

People with bad or no credit history might find it difficult to find a lender or provider willing to consider their application, whether it’s for a loan or credit card.

This is where products that have been specifically designed for bad credit – such as bad credit credit cards and bad credit loans – could help.

However, it’s vital to remember that just because you could apply for a bad credit credit card, it doesn’t mean that you should.

There are several things to consider before you apply for a bad credit credit card – we’ll take a look at this in more detail in the next section.

Credit cards for bad credit: think very carefully before you apply

- A bad credit credit card could come with a higher rate of interest.

- You could be offered a lower starting credit limit. A lower credit limit is usually in place to help you manage responsible spending.

- Some credit cards may come with standard and/or additional fees, which could increase your cost of borrowing. Examples of possible fees include annual, transaction, and early repayment fees.

- If you do decide to apply for a credit card, you should never spend more money than you need to or can afford to repay.

Will using a credit card for bad credit damage my credit score further?

We’ve talked about the positive effects a credit builder credit card could have on your credit score. Below, we’ll explore the ways that your score could be harmed by a credit card, if not managed correctly.

- Try to keep your credit card applications to a minimum. When you apply for a credit card, the provider will complete a creditworthiness assessment. A creditworthiness assessment will include a hard search or Open Banking. Please be aware that a hard search will remain visible on your credit file for up to 12 months, and multiple hard searches in a short space of time could damage your credit score.

Some credit card providers allow you to check your eligibility before you apply. This could give you an idea of how likely you are to be approved for a certain credit card without impacting your credit score. - Make at least the minimum repayment amount due on your balance each month. A late or missed repayment will cause your credit score to decline.

- Stay within your credit limit. Spending outside of your credit limit could harm your credit score.

- Be aware of your credit card utilisation. This is the amount of money you’re using of your total credit limit and is usually shown as a percentage. If you’re aiming to improve your credit score, you should keep your credit card utilisation as low as possible.

- Avoid using your credit card to withdraw money from a cash machine. This is known as a cash advance and could signal poor money management.

Can I apply for a bad credit credit card?

Every credit card provider has their eligibility criteria that must be met before you think about making an application.

While this will vary from lender to lender, you will usually need to be:

- Aged 18 or over;

- A UK resident; with

- A UK bank account.

Some credit card providers may also require a minimum of three years’ UK address history.

Bad credit credit card with no credit check

You can’t get a credit card without undergoing a full credit check, known as a creditworthiness assessment.

The Financial Conduct Authority (FCA) requires all responsible credit providers and lenders in the UK to carry out a creditworthiness assessment on anybody who makes an application.

Any provider that claims to offer ‘no credit check credit cards’ is unlikely to be operating within FCA guidelines.

Before you share your personal and financial information with a company, you should search for it on the FCA’s Firm Checker tool.

How can I improve my credit score?

A credit builder credit card is just one way that you could begin your journey towards a healthier credit position.

- Check your credit report for errors. If you spot any inaccurate or outdated information, report this to your credit reference agency (CRA).

- Pay your bills on time each month. You might consider setting up a Direct Debit to make sure the payments are made on time.

- Register to vote. Being on the electoral roll makes it easier for providers to verify you at your current address.

- Try to reduce any existing debt as much as possible. Clearing active debt could increase your credit score.

- Limit the number of credit applications you make. Numerous hard searches close to one another will harm your credit score. When searching for credit, you might consider using a credit broker to help protect your file from multiple searches.

I can’t afford to repay my credit card; what should I do?

If you’re concerned about an upcoming payment, you should contact your credit card provider as soon as you can. They will talk you through any options that could be available.

Don’t continue to spend on your credit card if you can’t afford to repay the money you owe.

Reaching out and asking for help can feel daunting, but please know that you have nothing to feel worried or ashamed about.

If you need advice on money or debt management, please consider visiting any of the following sites for free, confidential support: StepChange, MoneyHelper, Citizens Advice and National Debtline.

Could I get a credit card for bad credit with CashLady?

CashLady is a credit broker working with a panel of lenders who offer short-term personal loans. We do not work with any credit card providers.

If you’re looking for an alternative to a bad credit credit card, we could help you search for a suitable loan. A personal loan could plug a financial emergency, such as a broken boiler or a car in need of urgent repairs.

Several of the lenders on the CashLady panel specialise in loans for people with bad credit, although, as is the case with bad credit credit cards, a bad credit loan could come with a higher interest rate. In some cases, you might not be approved to borrow the amount of money that you need and may need to reapply for a lower amount.

You can search for a bad credit loan as a bad credit credit card alternative with CashLady if you:

- Are over the age of 18;

- Are a UK resident;

- Have a UK bank account; and

- Have a regular source of income paid into your bank account.

Why choose CashLady for your alternative to credit cards for people with bad credit?

- Since 2008, CashLady has helped match over 3 million customers with a suitable credit product.

- Our credit broking service is free to use.

- Searching for a bad credit loan with CashLady will not impact your credit score.*

- CashLady is authorised and regulated by the FCA.

- No-obligation quote.

- Our easy-to-navigate website is available 24/7.

- Our straightforward online form takes just five minutes to complete.

- The lenders on our panel offer loans from £100 to £10,000, with repayment terms between 3 and 60 months, depending on the amount of money you apply to borrow.

*If CashLady can match you with a loan and you make a full application with the lender, a creditworthiness assessment will be conducted by that company. This will involve a hard search or Open Banking. Please note that a hard search will remain on your credit file for up to 12 months, and multiple hard searches in a short space of time will cause your credit score to decline.