The 5th Century

Between 401 and 500 AD, in North Africa and the Middle East, the concept of ‘Hawala’ was born.

Based on principles of trust, Hawala was a method of providing fast loans from person to person.

Person 1 would lend money to Person 4. This money would not travel directly. Instead:

Person 1 would give their money to Person 2.

3 would give their own money to Person 4.

Person 3 would then get paid by 2, at a later date, using Person 1’s money.

1 has then indirectly provided money to Person 4.

For fast loans, the Hawala system is exceptionally efficient.

The borrower and lender can deal in cash without being in the same geographic space. Person 2 and Person 3 act as loan brokers, managing the transaction separately in their own time.

Since the money does not need to go directly from borrower to lender. Person 1 can pass their money to Person 2 and, almost instantly, Person 4 can collect the same funds from Person 3.

The money received by Person 4 in a Hawala agreement is not actually Person 1’s money. Trust is important because Person 3 is giving their money to the borrower. The word ‘Hawala’ itself actually means ‘trust’.

It is crucial that both loan brokers in this four-way transaction can trust one another. Otherwise, the system fails.

Hawala: an example

Person 1 lives in Australia. A relative, Person 4, resides in the UK. Person 4 requires a loan of £100. A family member agrees to fund this loan.

Person 1 meets with a loan broker, Person 2.

Meanwhile, Person 4 is in contact with a separate loan broker, Person 3.

Person 1 pays Person 2 the equal of £100 in British Sterling. Person 2 contacts Person 3, who pays the same amount of money to Person 4.

1 has now given their money. Person 4 has received their loan.

Person 3 is empty-handed and Person 2 has £100. The money transfer has been almost instant. Person 2 and Person 3 will then settle the debt in their own time, with Person 2 paying the cash to Person 3.

Hawala: the history of payday loans

There are many differences between Hawala loans and the payday loans of today. In fact, today’s loans are often direct between the lender and the borrower.

When loan brokers get used, they connect the borrower and the lender. Loan brokers do not provide their own financial input.

Although there are differences. There are also features that link the Hawala loans of the past to the payday loans of today. Primarily, the ability to provide fast transfer of money from one party to another.

The need for fast access to borrowed money is a need that prevails today. As the primary reason for the existence of payday loans.

Temples in the 10th Century

10th Century temples offered a secure place for wealthy people to store their valuables.

Because valuables were often in the form of precious metals. Such as gold, it also meant it could be easily stolen.

In early civilisations, temples were one of the safest places to store goods as it was a solid building. It was always attended in some way. And the religious importance would deter many criminals from considering an act of crime.

In the 18th century, in Babylon during the time of Hammurabi. There are records of loans getting made by the priests of the temple. Where we can see the early concept of modern banking evolving.

The evolution of the modern banking systems

The 1920s

Banking systems have evolved over the centuries.

Over time, banks closer to those that we recognise today were set up to formalise this service.

Only since the 1920s, following World War One, have banks been more prevalent.

In the early days, banks were only available to the most wealthy and well-connected.

References, along with documents to show evidence of creditworthiness. Would need to get provided just to open an account.

It was almost impossible to borrow money in the 1920s. Where only the wealthiest could expect to take out a loan.

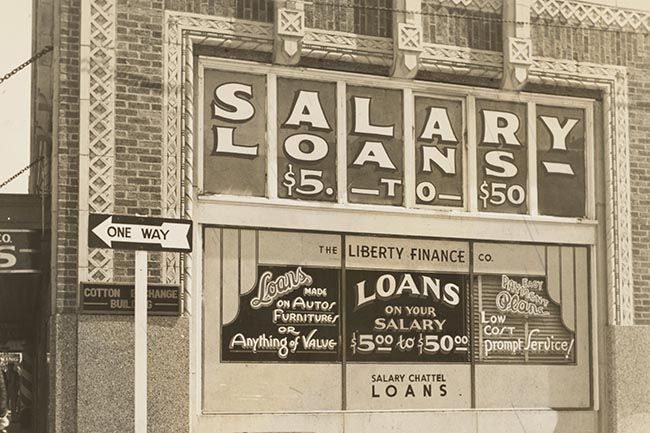

Bank loans: 1930s to 1950s

Bank loans were out of reach for the majority of people. They would often turn to pawnbrokers when they needed financial help.

Borrowers would use pawnbrokers for secured loans. Providing a valuable item (such as a piece of jewellery) in exchange for the money that they needed.

Much like modern-day payday loans, the loans provided by pawnbrokers were often given on short terms. They were also for relatively small amounts of money.

Borrowers had to pay back their original loan. Plus interest, before the deadline for their loan ran out.

If a pawnbroker did not receive their repayments on time, they would sell the borrower’s valuable item to get their money back.

To make a profit if borrowers didn’t repay their debt, pawnbrokers provided loans for smaller loan amounts. Rather than the securing items were worth.

Pawnbrokers still exist today but they are not quite as popular as they once were.

In fact, they are often the last resort after payday loans and other credit options.

Cheque Cashing in the 1970s

Following the success of pawnbrokers in the early to mid-1900s, cheque cashing stores became a common sight on the high street.

These worked in much the same way as modern payday loans.

Consumers could visit a cheque cashing store. Providing a signed and post-dated cheque in exchange for the cash. Minus service fees and interest.

Borrowers could receive money when they needed it. With the lender cashing the cheque as soon as it became valid. The borrower did not need to return to pay off their debt. As the money would automatically get taken when the cheque got cashed.

Most borrowers would post-date their cheques. So that the money would get taken after their next payday. Making these cheque cashing services the original payday loans.

Cheque guarantee cards, introduced in 1969, provided reassurance and protection for lenders. Most offered a guarantee of up to £100.

If a borrower wanted a larger loan. Many cheques would get written so that each got covered by the guarantee.

A pawnbroker might not have been able to sell the item that they had got. A guaranteed cheque was a more secure offer from a borrower. Consumers also benefited, because they were providing a piece of paper. Rather than a valuable or sentimental item.

Cheque cashing stores became popular. Overtaking pawnbrokers as the main source of quick cash loans. In fact, many pawnbrokers expanded to offer this service.

Whilst cheque cashing stores still exist to this day, payday loans provide the same service in a much more accessible way. Cheques are rarely still used.

Banking system changes – The 1980s

After decades of strict regulation, the Thatcher government relaxed the banking restrictions. Suddenly, people that were unable to sign up for a bank account could open an account in their name.

Borrowing was also easier. More people were able to take out loans and mortgages. Buying their own homes and using borrowed money for their purchases.

It did not take long for people to become accustomed to borrowing money.

Some overspent. Because they had credit options available. Whilst others were able to live, rather than just survive, for the first time.

Despite this, getting a loan in the traditional way could still be a challenge for many.

Payday lending – the 1990s and 2000s

With unsecured credit becoming increasingly available, but still not meeting every need. Payday loans came into existence.

These were particularly appealing to those that struggled to get a traditional loan from the bank.

Already in the habit of spending. Many people found it easy to convince themselves to borrow from payday lenders.

Buying on credit was now considered the norm, which meant that people felt relaxed about borrowing.

Whilst people in the 1920s had found it almost impossible to take out a loan, or even set up a bank account, the 1990s and 2000s were very different.

Payday loan companies now provided consumers with incredibly easy options. And processes with which to get desired funds.

The World Wide Web made borrowing even easier. With safe online applications making short-term credit a viable option for many.

Cash could get sent to a bank account in a short space of time. Often minutes. Which meant that online lenders could now compete with established high street locations.

Consumers also enjoyed the privacy of online payday loans, which helped them to be discreet about their borrowing. They could apply from the comfort of their own home, often too easily.

Overuse of payday loans

During this period of industry boom, too many people made use of payday loans.

Regulations were not strict enough and loans could get taken out on impulse.

The payday loan industry then went largely unchecked.

Lenders provided short-term loans without running through affordability assessments.

They charged high levels of interest and excessive late payment fees.

Many turned to unscrupulous methods of debt collection when customers couldn’t pay back their loans.

From 2008-2012, the industry grew quickly. Consumers thought of payday loans as a fast and easy credit option, but often fell into difficulty when it was time to repay their debts.

According to the Competition & Markets Authority, 1.8 million people had payday loans in 2012. The Consumer Finance Association estimates between 7.4 and 8.2 million loans in total. With many borrowers having at least two loans to their name.

Although payday loans intended as a low-value form of credit. With lenders typically providing between £100 and £1,000 per loan. The average payday loan debt in 2012 stood at £1,200.

As a result of borrowers getting out of their depth, lenders (roughly 240 in number by 2012) began to develop a bad reputation.

Evolution of the payday industry – 2010 to 2015

From 2010 industry growth slowed down as many consumers became less trustful of payday loan companies

Risks associated with short-term, high-cost borrowing were more widely understood. And many well-known lenders became well known in the media for all the wrong reasons.

With regulation before 2014 not being effective enough. The newly created Financial Conduct Authority looked to clean up the industry and began regulation in April 2014.

The Financial Conduct Authority replaced the Office of Fair Trading. Which had regulated since 1973. And the Financial Service Authority which regulated from 1997 until 2013.

Payday loan sector – FCA review

Few occasions in the history of payday loans were as big as the FCA’s review.

The payday loan industry got reviewed in detail by the newly-formed FCA to ensure the safety of borrowing. With all lenders including those approved by the FCA’s predecessors before. They had to go through enforced re-authorisation.

The FCA looked into each lender and loan broker. And checked that they adhered to stricter regulations. Many lenders got refused authorisation because they couldn’t meet FCA standards.

There were also many lenders that left the market. Unwilling or unable to adapt to industry changes.

Lenders that were fully authorised by the FCA got placed on the Financial Services Register. Where consumers could search for trustworthy companies to borrow from.

This register was important. Because it now gave consumers a place where they could research lenders and brokers. To ensure they met the highest standards of the FCA and adhered to FCA guidelines.

Tighter regulation of payday loans

As a result of the FCA’s tighter regulation, many lenders had to pay compensation to consumers.

In June 2014 Wonga, the UK’s largest provider of payday loans, paid a total of £2.6 million in compensation.

In October 2014, 330,000 Wonga customers had their debts completely written off. This was as a result of inadequate affordability assessments. More so when the money was originally borrowed.

Introduction of caps by the FCA

In January 2015, the FCA introduced caps to make loans fairer and more affordable.

The regulator capped interest rates at 0.8% per day. Default fees got capped at £15.

No borrower, following the FCA’s cap introduction, would ever have to pay back more than double their original loan amount.

Increasing trust

In 2015, 3.5 million people took out payday loans.

These short term loans became increasingly popular once again. As consumers learned to trust lenders working under the new FCA regulations.

Payday lending in 2016

According to a Competition & Markets Authority consumer survey, 79% of people have used short term loans.

Roughly a third of these people have used them on many occasions, with five or more loans in total. These include loans taken outside by side, consecutively or on entirely different occasions.

The three largest lenders serve roughly 70% of the entire market between them. The most well-known of these, Wonga, has an estimated market share of between 30% and 40%.

Currently, the ten largest lenders receive 90% of all market revenue.

There are many smaller lenders making up the remaining 10% of the market. Along with new payday lenders that occasionally join with their offerings.

The future of payday loans?

The history of payday loans has not always been positive.

There have been turbulent years, affecting consumers and lenders alike.

Now, as the industry rebuilds, payday loans are more widely appreciated. And have established their place in the credit market. Amongst many other options such as credit cards, store cards, overdrafts and traditional loans.

Borrowers are discovering that a short term loan, even with high interest, can be more affordable. Than some alternatives.

For example. A cash loan might be a cheaper alternative to an unauthorised bank overdraft.

The other benefits, such speed of access to money and the potential to get accepted even with a poor credit rating. Are often crucial factors when people need an emergency loan and have nowhere else to turn.

Whilst short term loans are not suitable for everyone, they are an option that anyone can consider.

Technological advances are improving the lending industry. Along with more variety to the types of loans available, including text loans.

FCA regulations have reduced competition from a cost perspective.

Where lenders once used their fees and charges to compete. They have mostly fallen in line by following the FCA’s price caps. And instead of looking at how they can improve their value proposition.

Most importantly – more focus on serving the customer.

As the industry rebuilds and evolves, lenders will be finding ways to carve out their own niche. For companies to survive they must rely on strong reputation and impeccable service. And where possible, offer something new and different to stand out from the crowd.

Affordability assessments

Affordability assessments are now much more thorough and detailed. So providing even more protection for consumers.

More stringent affordability assessments can also benefit lenders, reducing the risks of costly defaults.

Some lenders are now able to link their platform directly to a borrower’s bank account. Automatically checking balances and statements to improve the borrowing experience.

Lenders can then ensure that their customers have enough money coming in to cover the loan repayments. And even expect potential unauthorised overdrafts.

Any financial trouble can get flagged quickly. So issues get resolved efficiently, often automatically.

Many may have heard about loans without credit check. The important thing to understand is that there is no real legal no credit check option on the UK market. Providing a loan without a credit check is illegal in the UK. People normally understand a no credit check payday loan as a form of a soft credit check that estimates your chances for being approved for real credit.

Revolving credit

Arguably, revolving credit is the evolutionary next step for the payday loan industry. This involves offering loans on similar terms to credit cards. With a greater credit limit and an ongoing agreement.

With revolving credit, borrowers can withdraw funds and repay them as often as they need to.

Despite the option of revolving credit, many consumers prefer to stick to more traditional payday loans.

With these, there are clear limits and deadlines to keep borrowing under control.

Summary

Payday loans, as we recognise them today are a relatively recent creation.

Yet, the history of payday loans spans not just decades but centuries.

There has always been a need for fast access to money, for as long as currency has existed.

As we now know, the demand for an instant loan went as far back as the 5th Century. When people built networks of trust to get money from A to B in hours.

In more recent times, following World War One. Banks took on the role of serving the wealthiest members of society. Those that were not considered wealthy relied on pawnbrokers. And later, cheque cashing shops, to provide a loan when needed.

Pawnbrokers and cheque cashing shops served as the earliest payday lending facilities. Allowing people to borrow money for short periods of time. Until they had got paid and could repay their debts.

Under the Thatcher Government, banking restrictions got relaxed. Many people were able to open bank accounts for the first time. And personal loans were also more widely available. Though still not an option for everyone.

Payday loans became popular because they opened the world of borrowing for the average consumer.

There were few regulations, which meant that it was easy to get a loan.

Applications were discreet, made online, and funds were quickly transferred.

Where credit had once been unavailable to most, it was now freely offered.

Yet, some people borrowed far more than they could afford to pay back. Which led to many people getting into financial difficulties.

The Financial Conduct Authority, founded in 2013, brought stricter regulations to the industry. Some lenders had to pay compensation. Some had to write off debts and others got closed down completely.

The FCA introduction of caps in 2015, made short-term loans more affordable, predictable and fair.

Studies now show that millions of people have had at least one payday loan.

Under strict FCA regulation, these loans can be much more carefully managed and may be more affordable than some other forms of credit.

As the industry continues to evolve, it is important that consumers are fully educated about any credit agreements. And receive help and support (where possible) in managing their money correctly.